How to add I-SIP URN number in HDFC Netbanking

Under i-SIP, you may initiate an SIP for funds using a secure and automated gateway. To use the i-SIP facility, you need to have Netbanking-enabled account which needs to be KYC compliant as well.

The bank where you are holding a saving account has to be the one approved to offer an i-SIP facility.

You can follow these easy steps to avail an i-SIP facility.

Steps to activate your SIP through HDFC Netbanking:

- Go to HDFC netbanking page

- Login with your credentials into your account.

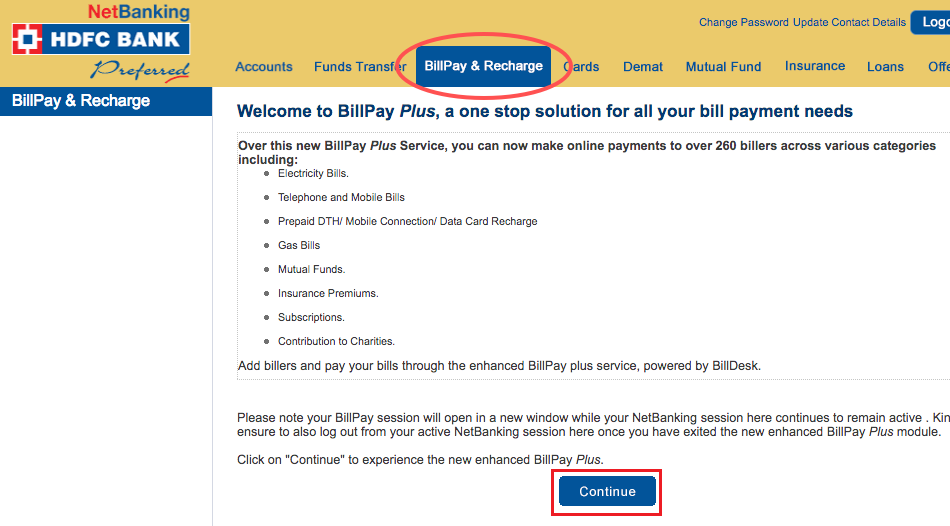

- Inside HDFC Net Banking Portal Go to BillPay & Recharge > Add Biller > Click on Continue.

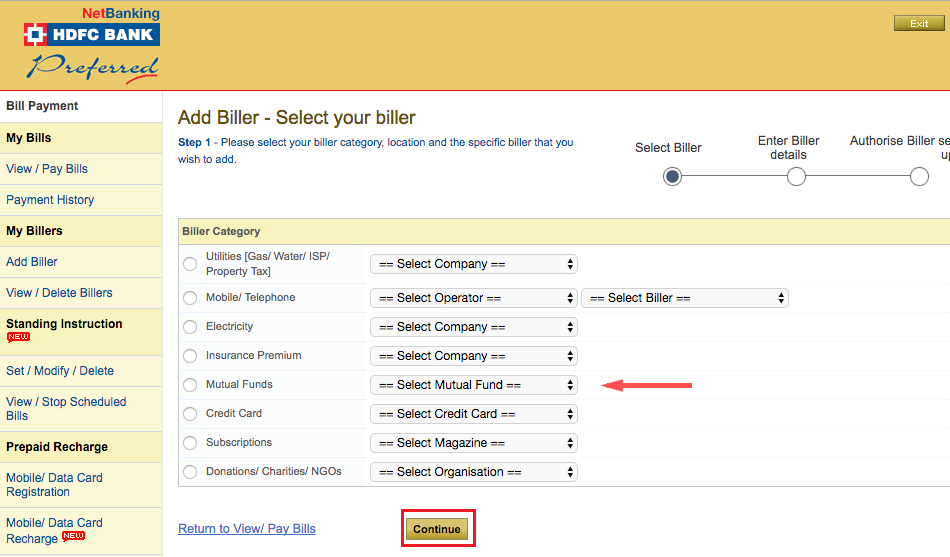

4. Click on Mutual Funds

5. Select BSE Limited when the drop down opens.

6. You will come to the biller details screen. Enter the following as described in the image below:

- Add unique registration number(URN) for that fund shared with you.

- Add "BSE SIP" as Name

- Set standing instruction as Yes.

- Set Pay entire bill amount as Yes.

- Set payment mode as bank account

- Select bank account from the drop down list

- Click Continue to save

7. Click confirm again

8. You will see that the biller has been approved on the confirmation screen.

9. You can view the added billers under registered billers section.

Why should you do this?

- Hasslefree – You do it once and every month your investments get done automatically.

- Paperless – No need to sign any cheques or courier any documents.

- Secure – It’s completely safe as all your investments go through your net banking account.